-

Into the Lion’s Den: how a small Canadian production company became a global leader

- by Caifu Global

In 1997 Canadian investment banker turned mining mogul Frank Giustra saw more lustre in the then booming Vancouver film industry than $250 oz gold, and so Lions Gate Entertainment was born. With an initial investment of $16 million from Giustra and his partner Avi Federgreen and a further $40 million private placement, Lions Gate was created through the assembly of several small production companies and distributors, primarily Montreal based Cinepix Film Properties (later moved to Vancouver under the Lions Gate banner).

With an initial investment of $16 million from Giustra and his partner Avi Federgreen and a further $40 million private placement, Lions Gate was created through the assembly of several small production companies and distributors, primarily Montreal based Cinepix Film Properties (later moved to Vancouver under the Lions Gate banner).

Their IPO price (on TSE) in 1998 was $4, but had dropped to $1.40 after their first year in operation, despite only minimal losses. Part of that may be attributed to their 45 percent stake in Mandalay Pictures, with controlling interest held by blockbuster Hollywood producer Peter Guber. It was a subsidiary of Mandalay Entertainment, which Guber had former as a part of a severance package from Sony Pictures three years earlier, and the move by Lions Gate was seen by industry observers as a poor one on their part as they had put up almost all of the money, shared little benefit and had a lot of exposure.

Just out of the gate and Giustra, who had proven himself a shrewd investor in other industries, was realizing the movie business was a different animal altogether.

Seeking to gain more company control of the stock his board agreed to a consolidation and transfer from TSE to the less respectable American Stock Exchange.

Despite some low budget hits such as American Psycho starring Christian Bale (which did a very respectable $34 million domestically) producing movies and television it appeared was not Giustra’s forte.

He stepped down from Lionsgate Films (a subsidiary of Lions Gate Entertainment) in 2000 and from Lion’s Gate Entertainment in 2003. Soon after Lion’s Gate experienced a rise in fortunes, with the first of what would become the highly profitable Saw series of (seven) films coming out in 2003, followed in 2004 by the Michael Moore documentary Fahrenheit 9/11, which did a very unexpected $222 million domestically.

Soon after Lion’s Gate experienced a rise in fortunes, with the first of what would become the highly profitable Saw series of (seven) films coming out in 2003, followed in 2004 by the Michael Moore documentary Fahrenheit 9/11, which did a very unexpected $222 million domestically.

This turn in fortunes could more fairly be ascribed to good luck than Giustra’s departure, as no U.S distributor had wanted Fahrenheit 9/11 thinking its controversial subject matter would turn away filmgoers. Saw was a low budget horror movie (budget $1.2 million against $104 million domestic box office) that caught on and spawned six more films, again against all expectations.

The John Feltheimer years: In 2000 American film industry executive John Feltheimer became CEO of Lionsgate Films and in 2003 Co-Chairman of Lions Gate Entertainment.

He moved the company away from producing and instead turned to building a substantial film library through the acquisitions of Artisan Entertainment and Trimark Holdings, in the belief that demand for content was going to grow exponentially in the near future.

As we have seen that strategy has served Lions Gate well, as new international markets for film and television has expanded, and domestically, increased cable channels, satellite programing and online streaming have driven demand for content. Lions Gate continued its acquisitive phase, moving into the U.K with the purchase of Redbus Film Distribution, and acquiring the lucrative Twilight franchise through its purchase of Summit Entertainment. The head office was moved to Los Angeles (offices are still maintained in Vancouver) and their stock was listed on the NYSE (LGF), film production was further curtailed as the burgeoning studio’s main focus became distribution.

Lions Gate continued its acquisitive phase, moving into the U.K with the purchase of Redbus Film Distribution, and acquiring the lucrative Twilight franchise through its purchase of Summit Entertainment. The head office was moved to Los Angeles (offices are still maintained in Vancouver) and their stock was listed on the NYSE (LGF), film production was further curtailed as the burgeoning studio’s main focus became distribution.

A Hostile bid:

In early 2010, the studio’s improving fortunes attracted the interest of legendary corporate raider Carl Icahn, who managed to acquire 18 percent of the company and attempted to purchase 30 percent with a tender of $6 a share. With the intention of eventually acquiring 100 percent of Lions Gate, presumably to restructure the company and possibly sell off its valuable film/television library. He was initially unsuccessful, but eventually purchased 37 percent of the company when two major shareholders decided it was time to take their profits and run. Lions Gate chose a poison pill defense in a $100 million debt to equity swap in the form of convertible notes. Icahn’s last attempt at control of the company came in the form of a proxy battle in late 2010, but he was unsuccessful at stacking the company’s board with five directors chosen by him. He eventually sold off his remaining stake in the company at $7 a share for a total of $310 million (no net gain).

The acrimony over the failed bid remained however, and in 2014 on the Shareholders Square Table Blog He called Lions Gate, “Liars Gate” and railed against chief executives (like those at Lions Gate) who take huge compensation packages with little relation to a company’s bottom line.

The man who quietly made a billion dollars:

While Lions gate was busy fighting off Icahn’s hostile bid for control of the company a little known fund manager, Mark Rachesky, was buying up Lions gate stock at $4-$6 a share. His fund, MHR Fund Management, now owns a 35 percent stake in the company. During Lions Gate’s war with Icahn he was appointed as a friendly director as an ally against Icahn’s hostile bid. Three years later Rachesky’s investment in Lions Gate had more than quadrupled as the stock rose to $26, and then almost doubled again as it hit the $40 mark. This did not sit well with Icahn, who was at one time Rachesky’s mentor. Although certainly pleasing to his fund and their clients. Rachesky was named Vice-Chairman of Lions Gate in 2010.

Then there was the Hunger Games franchise:

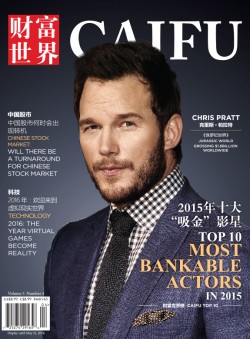

Distributed by Lions Gate the Hunger Games is another young adult property based on a series of books like the Twilight series. Worldwide box office for the first three movies is over $2.1 billion. With the success of Hunger Games and Twilight Lions Gate rose to prominence as a mini-major, meaning in the eyes of the film industry while it wasn’t 20th Century Fox or Sony Pictures, it was certainly above being an independent distribution/production company. This status gives it the cache to get large projects underwritten and attract larger pools of capital as the company continues to diversify into TV production, online streaming and other entertainment ventures.

With the release of the third Hunger Games film in November 2015 their stock briefly broke $40, after a steep climb from $2 less than five years ago, and hovering in the $35 range for the better part of the last three years. Although the last film, while the most expensive to produce was the most underperforming (still a respectable $650 million worldwide) leading some to doubt that there is that much appeal left for more Hunger Game movies.

What’s next?

Since that historic high last fall, Lion’s Gate’s price has fallen more than 50 percent, trading at $19 at the time of this writing, after briefly dipping into the $18 range. This is thought to be due to flagging confidence in the Hunger Games franchise, as well as the end of the Twilight series, both of which were largely responsible for driving the company’s stock price in the last several years. There were earlier rumours that Lions Gate might yet be the target of another takeover attempt, this time by Jack Ma’s Alibaba.

In the end Lion’s Gate partnered with Alibaba Pictures in 2014 to create an online streaming service.

That deal was followed a year later by a $1.5 billion partnership deal with Hunan TV to finance film projects, and to create TV content for both the Chinese and international market.

Felthiemer has said that Lions Gate’s future is intertwined with China.

And Frank Giustra?

In 2010 Frank Giustra rejoined the board of Lions Gate (as part of their proxy fight with Icahn) and his interest in the movie business was rekindled, forming Thunderbird Films as a joint venture with Lions Gate in 2012. To date Thunderbird has been a modest success producing television series, television movies and soon major motion pictures.

Entertainmnet

-

One Worth Watching: Josie Ho

- by Caifu Global

Multi-talented Hong Kong star, Josie Ho, is a rockstar and actress in Hong Kong. She is a hardworking heiress — those two characteristics do not often appear together — who has released eight music albums and starred in over 25 films throughout her career. She is also well known as the daughter of Stanley Ho, a casino billionaire who made his fortune in Macau and is often referred to as “The King of Gambling.” Ms. Ho says her family did not fund her career but she was inspired by family friends in the entertainment industry such as Jackie Chan.

-

The Rollercoaster Ride of the Chinese Theme Park Industry is Just Beginning

- by Caifu Global

Until now, local companies have been the dominant players in the Chinese theme park industry. However, the current players are under siege from foreign developers, as well as mainland conglomerates with an eye for expansion into this industry; but the real shake up starts when the happiest place on earth opens in Shanghai. Disney will launch its third theme park in Asia on June 16, 2016. The resort, located in the Pudong district, covers almost one thousand acres. Expectations are high. And Shanghai Disney Resort is a just one of many foreign theme parks under development in China.

-

Entertainment M&As: Rutledge Masterminds Cable Megadeal and the Legendary Wang Jianlin Buys a Hollywood Studio

- by Caifu Global

In 2015, cable companies in the U.S. dominated the media, entertainment and communications sector in mergers and acquisitions. According to a February 2016 PricewaterhouseCoopers report, Charting the Future, overall M&A deal value in 2015 was US$149-billion, a 13 percent increase from the previous year. Deal volume, on the other hand, was down by 7 percent from 2014. A few megadeals — transactions valued over US$1-billion — accounted for most of the M&As. Honourable mentions for 2015 include European’s Altice NV’s acquisition of 70 percent of Suddenlink for US$9.1-billion, with the same buyer subsequently splashing out US$10-billion for Cablevision. The biggest cable deal, however, was between Charter Communications Inc. and Time Warner Cable Inc (TWC).